$104 Million in Premium and 125 Associates

Arlington/Roe purchased Southern General Agency in Bowling Green, Kentucky, purchased Agents Advantage Network in Nashville, Tennessee, opened an underwriting office in Grand Rapids, Michigan, and hired the first Ohio associate. Each location came to be because of the talent Jim Roe saw in people who lived there.

Patrick Roe Joins Arlington/Roe

Following in the footsteps of grandfather, Francis “Leo,” and father, Jim, Patrick joined his brother Andy at Arlington/Roe as the second member of the third generation of the Roe family. He first began working as a Personal Lines Assistant Underwriter and Underwriter. After five years, he transitioned to a

Andy Roe joins Arlington/Roe

Andy Roe joined Arlington/Roe as the first member of the third-generation of the Roe family. Three years after joining the company, he spent some time in his early insurance career interning for an Excess & Surplus Lines company in Arizona and in London with Lloyds. After Lloyds of London,

$59 Million in Premium and 64 Associates

The longstanding relationship with Foremost was moved to American Modern Insurance Group. Jim Roe served as president of the American Association of Managing General Agents, AAMGA. Arlington/Roe moved to its current home office at 8900 Keystone Crossing in Indianapolis and opened an underwriting office in Geneva, Illinois, purchased Cooling

$15 Million in Premium and 25 Associates

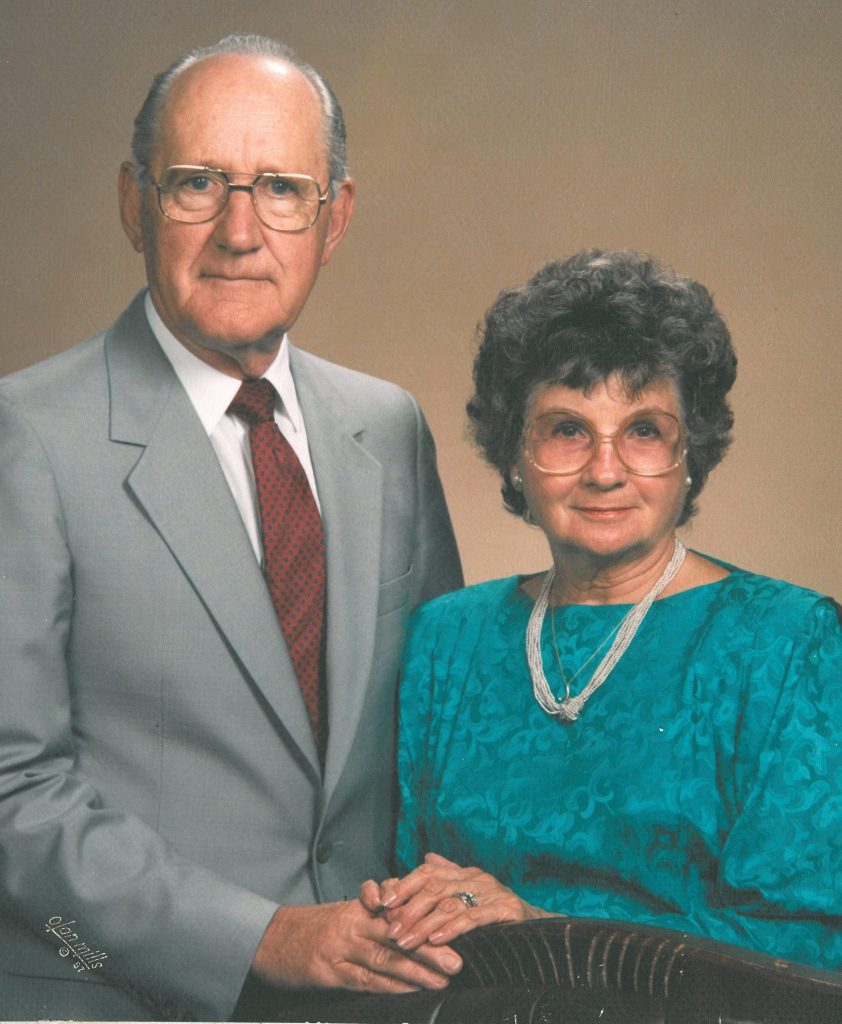

As a member of the National Association of Professional Surplus Lines Offices (NAPSLO) board of directors, Jim expanded his involvement in the industry from regional to national. Arlington/Roe moved to 8465 Keystone Crossing. An aviation insurance office was established in Louisville, Kentucky. Vickie Roe, Jim’s wife, joined the agency.

Arlington/Roe celebrates 25 years and obtains a logo

In 1989, the company celebrated its 25th anniversary. Jim had been highly encouraged to give the company a logo. He then stated he would pay $100 to anyone who could come up with a logo that he liked and suited Arlington/Roe. A young staff member, who was an amateur

$7.5 Million in Premium and 18 Associates

Francis Roe died unexpectedly at the age of 64. Jim became the sole owner of Arlington/Roe and began to mold the culture and values of the company to dramatically grow the business.

$3.5 Million in Premium and 13 Associates

Arlington/Roe moved to Shorewood Drive just east of 56th and Keystone. Jim Roe worked with Hugh McGowan, Sr. in writing the Pan American Games held in 1987. The market was hard, and the agency did not have all the players or the markets to take full advantage of the

$1.3 Million in Premium and Seven Associates

In 1980, Jim rejoined his father and they changed the family business name to Arlington/Roe & Co. Francis and Jim got busy growing the business. They joined the Big “I,” PIA, 1752 Club and Blue Goose. Jim earned his CPCU designation. They joined NAPSLO in 1981 and AAMGA in

Four years later, Jim left the agency.

He left the agency to work on the company and agency side with Hartford Insurance Co. as a western Kentucky marketing representative, then an independent agent with the Charles Moore Agency in Bowling Green, Kentucky.